This is the second article of our “Lump sum budget model in Horizon Europe” series. In case you’ve landed on this present article first, we do invite you to begin with the first article that provides a thorough explanation about what lump sum is and how it works.

As well, we invite you to review the third article that addresses some of the most frequently asked questions we receive regarding lump sum.

From our ongoing work and experience with this model, we’ve come to note some existing discrepancies between the written information about lump sum, and what is expected in practice. Specifically, we’ll elaborate on two critical issues that are inherent to the lump sum model, which may have significant implications. Additionally, we will offer our methods and insights for managing these discrepancies.

Lump sum model – aspects to be aware of

The two critical and inherent lump sum model aspects are:

The EC regards these two aspects as great advantages of the Lump sum model. However, when looking into the details and the fine print of the official documentation, some ‘hidden’ implications surface that indicate a less favorable scenario than what the EC portrays.

It is our position that the potential implications of these two critical aspects must be well explained and acknowledged by anyone who applies for a Lump sum grant. Let’s dive into the details.

1. Budget Flexibility in the Implementation of Lump sum projects

Budget flexibility is always an essential factor in multi-annum consortium-based research projects. Oftentimes, the project’s original work plan will have to change (since it is only an estimation) due to unexpected changes, new insights, delivery problems, etc.

As a rule of thumb, flexibility is welcome in these grants (‘lump sum’ grants as well as in the traditional ‘actual cost model’ grants), as long as changes do not impede the ability of the project to reach its goals.

Flexibility in these types of grants can be manifested through either of the following dimensions (or a combination of them):

- 1st dimension – refers to the implementation of the work plan. This relates to any changes to the work plan (that do not jeopardize the project’s goals), but without changes in the budget utilization. The lump sum model should not present a problem for this dimension of flexibility.

- 2nd dimension – refers to changes in the utilization of the budget during the project’s execution (per partner and/or per work package/collectively), in general, or as a consequence of changes stemming from the 1st dimension mentioned above. Unlike the 1st dimension, flexibility here may not be as simple as expected. We highlight this issue further below.

Changes in the implementation of the work plan – the 1st dimension

This is the easy part (as it does not involve shifting money…). Under lump sum projects, and similar to most other Horizon Europe projects, it is expected and accepted to adjust the work plan continuously. The nature of these projects calls for deviations (for any reason) from the original plan. If needed, Lump sum grants can be amended in order to adapt the work plan to the needs of the project, new scientific developments, or organisational changes. Such changes are allowed as long as they do not question the original selection decision and the project’s goals will be achieved according to the original project’s mission statement.

The nature of work plan changes in the 1st dimension usually involves the timeline of the work packages, potentially also affecting the timeline of the deliverables and milestones. As long as there is good justification, such deviations and changes are allowed, and should be documented in the periodic reports (or in the contract amendment, if these involve changes in the 2nd dimension, as explained below).

Note that such changes are subject to the review of the EC project officer. Only once these changes are approved by the project officer, the payment for the completed work packages will be approved and processed accordingly.

However, it is expected that in case of a work package rejection, the EC project officers may allow for some flexibility by approving partial payments for specific tasks that will be approved within the rejected work package. Another possibility is that the EC project officers may permit to continue working on the rejected work package (effectively prolonging its original timeline). Once it is done, the payment (or the rest of it) will be approved as well.

To sum it up – in lump sum projects, despite the fact that the payments are done only for completed work packages, it does not mean that it is impossible to amend the work packages timeline and complete them later than planned. In that sense, the ‘Lump sum’ model does provide a high level of flexibility.

However, the story is quite different when it comes to the 2nd dimension. Let’s see why.

Ready to learn all about the budget for Horizon Europe applications?

Discover our complete course. Learn all the written & unwritten budget rules.

Changes to the budget – the 2nd dimension

Changes to the work plan may lead to changes in budget distribution within the project, between budget categories, partners and/or work packages. This is considered normal practice for almost any multi-annum research project during its execution.

Horizon Europe acknowledges that. The general overall principle (irrespective of the lump sum model) of budget flexibility is defined in the Horizon Europe Grant Agreement Article 5.5.

However, while the definition of flexibility (as defined in Article 5.5) is rather flexible (no pun intended) in the traditional “actual cost model” projects, in lump sum projects this type of budget flexibility seems to be much more rigid and cumbersome. Let’s explain.

Let’s begin with the general overall principle of budget flexibility under Horizon Europe: “beneficiaries may transfer budget among themselves, between affiliated entities or between budget categories without requesting an amendment, and at the time of reporting — declare costs that are different from the estimated budget provided that the action remains in line with the description of the action” (AGA, Article 5.5, section 7). This means that as long as the project is running and reaching its goals according to plan, such changes can be done without too much administrative hassle.

Mandatory Contract Amendment in Lump sum grants

However, there are some exceptions to this general principle. Specifically, there is an explicit exception referring to lump sum costs: “changes to budget categories with lump sums costs or contributions […] always require an amendment” (MGA, section 5.5. Similar instruction appears in the dedicated ‘Lump sum MGA’ in article 5.5). This means that although budget flexibility is allowed in lump sum grants, it must be implemented using a contract amendment. This contract amendment is subject to very specific conditions when it comes to transfers between work packages that must be fulfilled (see below). The entire process must be officially reviewed and approved by the EC, which takes time and effort. Essentially this creates an administrative burden in lump sum projects, which does not exist in the traditional “actual costs model” projects.

The conditions that allow contract amendment in Lump sum grants

Since the need for transfer between work packages happens quite often in these projects, let’s have a deeper look at the specific conditions that must be met for such a contract amendment (set out in article 5.5 of the ’Lump sum MGA’). Note that these specific conditions may entail unplanned complexity, and it may not always be an easy process to get the EC approval for meeting these conditions. The conditions are:

“Amendments for transfers between work packages are moreover possible only if:

- the work packages concerned are not already completed (and declared in a financial statement) and;

- the transfers are justified by the technical implementation of the action.”

Let’s start with the second condition, which is the trivial one: the EC would like to see that there is a proper justification for the requested transfer. This makes perfect sense, like all budget-related issues in the programme.

However, the first condition is more complicated. The basic rule is that the transfer of funds is accepted only in case the ‘transferring’ work package is ongoing / not yet completed. Let’s review this condition using different scenarios as examples:

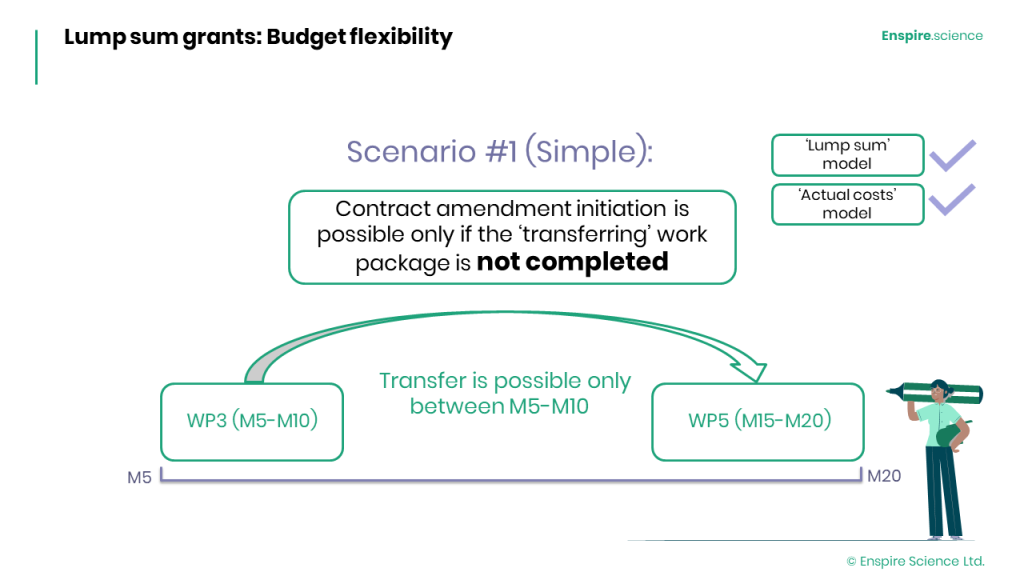

Scenario #1 (the simple scenario, image below). Work package #3 runs between Month 5 and Month 10 of the project. It is possible to transfer funds (budget surplus) from this work package’s budget to work package #5 (which needs more budget than originally planned) in this example, only before the end of Month 10. Afterwards, it is impossible to do that.

Compared to the more “regular” actual costs projects – the flexibility of transferring the funds exists, but the process is more complex in the lump sum model, as it requires an official contract amendment.

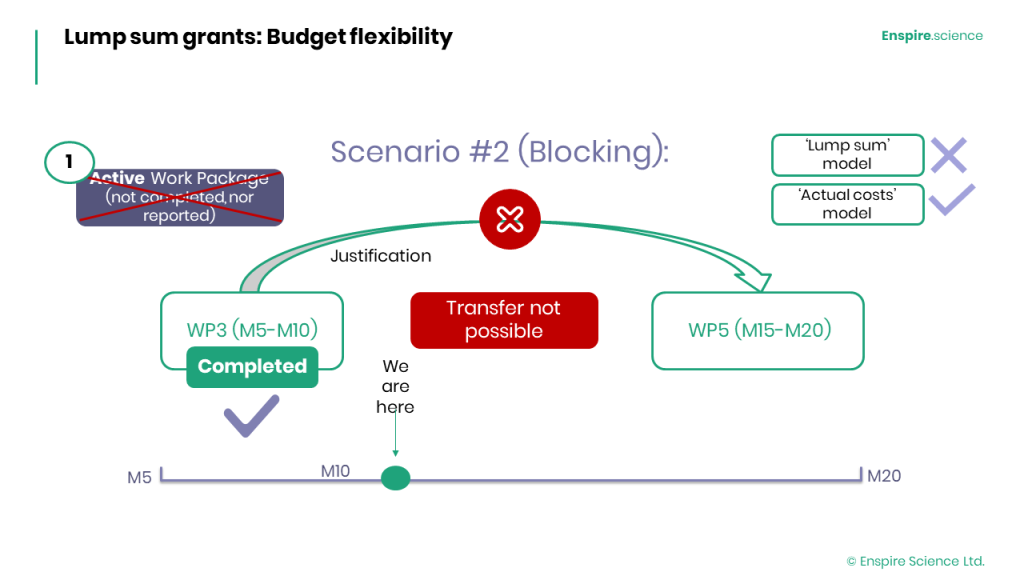

Contrary to that, in case of a completed work package, it is impossible (according to the instructions of article 5.5 of the ’Lump sum MGA’) to transfer funds from this work package to another.

Scenario #2 (image below), represents how the ‘Lump sum’ model effectively blocks the ability to transfer funds within the project. In this scenario, it became clear during the execution of work package #3 that it will not fully utilize its budget. Therefore, the consortium members decided that once they know exactly how much budget is left in work package #3, the excess budget will be transferred to work package #5 (which needs more budget than originally planned). However, for some reason, they initiated the transfer process too late (after the end of work package #3/reported). At that point, work package #3 is completed (and maybe also reported), and therefore this transfer is not allowed.

- Here the flexibility is blocked by the lump sum model’s rules. Traditional projects following the ‘actual cost model’ do not suffer from such blocks, and transfers can be easily processed at almost any time during the project.

The main takeaway from this scenario is to avoid delays & initiate transfer processes before the end of the transferring work package.

Scenario #3 (image below). In many cases, it would be impossible to anticipate ahead of time where and how the project can exploit such budget surpluses (from earlier work packages). Scenario #3 demonstrates this very common situation. By the end of work package #3, it is clear that there is excess budget (that can/should be used elsewhere for the successful execution of the project). However, at this point in time it is unknown where it can be shifted to, as budget needs of later work packages are not yet known at this point in time. Having no clear transfer target, means that there is no justification for the transfer (or that the justification is lacking). Only later on, for example during the execution of work package #5, it becomes clear that the excess budget from work package #3 is needed. At this point, although the justification has formed, work package #3 is already completed, and the budget can no longer be transferred.

- This means that under the lump sum model, the ability to adjust the project’s budget on-the-go is limited, effectively restricting the budget flexibility. Contrary to this, traditional projects that apply the “actual cost model” benefit from a much higher level of flexibility in the way the project’s budget is implemented and utilized (as long as the project reaches its goals according to plan, of course).

The bottom line here is that although budget flexibility is always an option, there is an extra mandatory administrative burden for lump sum projects.

Based on the above, we recommend the following when planning your lump sum project proposal:

- Have an in-depth budget planned ahead of time. Do not neglect or take this issue lightly.

- Specifically – devote extra effort to planning the work packages structure and links between the work packages, as explained in the 1st article.

- Re-visit the budget utilization issue in any work package during the execution, prior to the end date of the work package.

- In case of budget underutilization in a specific work package, we’d strongly recommend considering a well-justified amendment request to avoid the unfortunate scenario (as demonstrated in Scenario #3), to be submitted before the end date of the transferring work package.

Ready to learn all about the budget for Horizon Europe applications?

Discover our complete course. Learn all the written & unwritten budget rules.

2. Record keeping and potential financial audits

This is the 2nd Lump sum critical aspect that we wish to highlight in this article.

The official statements by the EC convey a relaxing message about record keeping and potential audits in Lump sum projects. Their overall message is that record keeping is relaxed in Lump sum projects (e.g. no need for time-keeping) and Lump sum projects might undergo audits on non-financial aspects only.

How accurate are these messages? Let’s have a deeper look into the details.

Potential financial audits

As mentioned above, the EC message is that Lump sum projects may be subject to audits on non-financial obligations only. This can refer to compliance with rules on intellectual property, ethics and research integrity, dissemination and exploitation of results, visibility of EU funding, obligations related to open science, etc. Their rationale behind this statement is rather clear and makes sense: as there is no reporting of actual costs or of resources incurred in the lump sum grants, there will be no checks, reviews or audits related to actual costs and the resources used.

However, the official Lump Sum Grant Agreement reveals that this is not necessarily true, and that lump sum grants can potentially be subject to financial audits at some point. It goes without saying that we should be ready for this option, even if it is currently declared as ‘not-an-option’ in various EC communications.

Here is why we insist that lump sum grants can be subject to financial audits: The official Lump sum Grant Agreement (a customized version of the Model Grant Agreement, dedicated to Lump sum grants) includes the regular Article 25, which sets the way audits are conducted in Horizon Europe projects, and there are no specific instructions excluding lump sum projects for that matter. This means that the EC reserves the right to conduct full financial audits to lump sum just like any other project under Horizon Europe.

Realizing that a financial audit is an option, we should attend to the next aspect – financial record keeping.

Record keeping

Unlike the traditional “actual cost model” grants, lump sum grant beneficiaries “do not need to keep specific records on the actual costs incurred” (Lump Sum MGA, Article 20.1). This is in line with the EC statements mentioned above.

What does it mean? Do you need to keep records in case of potential audit? How does it work in practice? Is it guaranteed that financial audits will not be conducted for lump sum projects?

The EC’s above-mentioned statement relies on the fact that there is no reporting of actual costs incurred in lump sum projects. This working assumption leads the EC to declare that under such circumstances, an audit will not be conducted since no actual costs are going to be reported. However, we believe that the situation is not as simple as portrayed by the EC. Let’s break it down to elements:

- The EC acknowledges that some recording of actual costs will in fact be conducted, since participating organisations normally do not act in a ‘financial void’. Meaning, despite the lump sum’s above-mentioned instructions about keeping records, organizations are still obliged to have local accounting and tax reports stemming from their regular financial conduct (recording of salary payments and bookkeeping in general will carry on regardless of the project execution terms).

- Therefore, in case the EC would like to have a financial audit, it will be possible as all relevant expenditures are expected to be documented in the organisation’s ledger. It may not be simple (as the financial documentation may not include the proper labeling of the specific tasks or expenditures associated with the project), but not impossible.

- In such an audit, the beneficiaries are obligated to provide any relevant records and supporting documents upon request (according to the dedicated Lump Sum Grant Agreement, specifically the instructions set in Articles 20.1, 19 and 25).

- Despite the relaxation communicated by the EC in general and in Article 20.1 (mentioned above), note that at the same time, Article 20.1 refers to Article 25: “The records and supporting documents must be made available upon request (see Article 19) or in the context of checks, reviews, audits or investigations (see Article 25)”. In turn, Article 25 includes the following overriding audit-related instruction: “The beneficiary concerned must cooperate diligently [with the auditors] and provide — within the deadline requested [set by the auditors] — any information (including complete accounts, individual salary statements or other personal data) to verify compliance with the Agreement.” (Article 25.1.3, Lump Sum MGA).

- Therefore, when examining the relaxation manifested in Article 20.1 of the dedicated Lump Sum Grant Agreement, which instructs the beneficiaries to have “only” “records and other supporting documents to prove proper implementation of the action” or “adequate records and supporting document”, to us, in light of all of the above, the difference seems to be only semantic…

To sum this up, according to the instructions of the dedicated Lump sum Grant Agreement, it is possible to have an audit in lump sum projects. Therefore, we recommend that if your organization participates in a lump sum grant, be prepared for that option. We note that this is in contrast with the EC statements, as presented above. Hopefully, the EC will clarify these issues or adjust the dedicated Lump Sum Grant Agreement to be in line with its statements about Lump sum projects.

Conclusion

While the EC tried to ease the processes under the scheme of lump sum projects, we believe the outcome is not as relaxed as many anticipated. Therefore, we urge you to set aside substantial time and resources to fully understand the lump sum grant, and then prepare a lump sum budget that is devised well both during the pre-award phase and then as well for the post-award phase. If you should need any specific assistance with that, we invite you to contact us for ongoing support on your research application.

Ready to learn all about the budget for Horizon Europe applications?

Discover our complete course. Learn all the written & unwritten budget rules.